The Symbiotic Relationship Between Tourism and Real Estate

Wandering elephants and prowling lions aren't just drawing camera-wielding tourists to Africa's wildlands – they're quietly reshaping property markets in ways that defy conventional real estate wisdom. Think about it: dusty, remote outposts once deemed worthless are now commanding eye-watering premiums simply because they offer front-row seats to nature's greatest shows. This isn't your typical property boom; it's a peculiar economic dance between wilderness preservation and human desire for authentic experiences.

A luxury safari lodge with viewing deck overlooking the African savanna, where property values have increased dramatically despite remote locations.

Infrastructure Transformation

Roads snaking through previously inaccessible terrain, cell towers rising from savannas, and solar arrays gleaming beneath the equatorial sun – these infrastructure improvements don't just serve lodge guests but fundamentally transform surrounding land values. In Namibia's remote Kunene region, plots adjacent to newly developed safari routes have jumped 165% in value since 2021 , despite being hours from the nearest town.

Rather than following development, these infrastructure improvements precede it, creating investment windows that savvy buyers now monitor through dedicated satellite imagery services – a peculiar niche industry born from this wilderness-urban interface.

We're not just building accommodations; we're crafting portals between worlds. Our designs must simultaneously offer world-class luxury while minimizing visual and environmental impact on the very landscapes that draw visitors in the first place.

Her recent project in Kenya's Lewa Conservancy reimagines the very concept of walls – using natural materials and innovative design to create spaces where boundaries between guest quarters and wilderness blur without compromising safety or comfort. The result? Properties that command $2,700 per night yet leave minimal ecological footprints.

| Location | Value Increase Since 2021 | Distance from Major City | Key Wildlife Attraction | Investment Opportunity Level |

|---|---|---|---|---|

| Namibia Kunene Region | 165% | 4-6 hours | Desert Elephants | Very High |

| Kenya Lewa Conservancy | 118% | 3 hours | Rhino Sanctuary | High |

| Botswana Okavango Delta | 145% | 1 hour (flight only) | Diverse Megafauna | Premium |

| Tanzania Serengeti Corridor | 132% | 5 hours | Wildebeest Migration | Very High |

| South Africa Kruger Periphery | 87% | 2 hours | Big Five | Moderate-High |

This architectural revolution challenges conventional luxury definitions by elevating invisibility into a premium asset – structures designed to disappear into landscapes are paradoxically the most visible on balance sheets.

Botswana's Counter-Conventional Tourism Model

Looking at Botswana's tourism model feels like studying an anti-textbook approach to development. While conventional wisdom screams "more is better," Botswana deliberately constrains supply – limiting bed numbers in prime wildlife areas like the Okavango Delta while charging correspondingly astronomical rates. One lodge in the heart of the Delta generated $4.2 million in revenue last year with just eight rooms – a return-per-square-foot that would make Manhattan developers weep with envy.

- Maximizes built structures

- Focuses on accommodation capacity

- Standardized amenities

- Views nature as backdrop

- Success measured by occupancy percentage

- Minimizes visible infrastructure

- Limits bed numbers deliberately

- Unique, place-based experiences

- Integrates with natural systems

- Success measured by conservation impact and premium rates

This counterintuitive approach has transformed Botswana's safari properties into the bluest of blue-chip investments, with waitlists for ownership opportunities stretching years.

Investment Patterns in Safari-Adjacent Property Markets

Animal migration routes have become the new beachfront in African investment circles – invisible highways tracked by GPS-collared wildlife that determine property valuations more accurately than any human assessment. Let me paint this picture: when researchers recently published updated wildebeest movement data for Tanzania's Serengeti ecosystem, property inquiries spiked 78% for parcels along newly identified routes within 72 hours of publication.

This peculiar fusion of zoology and real estate has created a specialized profession – wildlife-pattern investment advisors who interpret animal behavior studies for property acquisition strategies. In 2023, a modest-sized lodge overlooking a previously undocumented rhinoceros traversing zone in Limpopo sold for 3.8 times its assessed value , underscoring how profoundly wildlife movements influence market dynamics.

The lifecycle of safari destinations follows rhythms that defy traditional market analysis. Take Zambia's Liuwa Plain – ten years ago, you couldn't give land away in this remote flood plain. Then came a single, brilliantly conceived lodge, strategic conservation partnerships, and improved charter flight access.

The transformation of Liuwa Plain demonstrates how quickly property values can shift in wilderness areas when the right combination of conservation, accessibility, and thoughtful development converge. Land values skyrocketed 430% between 2018 and 2023, creating overnight millionaires among local landholders who had previously considered their inheritance worthless.

Yet this pattern isn't universal – Uganda's Kidepo Valley saw similar conservation investments but only modest 62% property appreciation due to persistent regional security concerns. Each wildlife region operates as its own microeconomy with unique growth triggers that standard investment models fail to capture.

Seasonal Dynamics and Property Valuation

Wet season, dry season – the heartbeat of the African wilderness creates fascinating ripples through property markets that would baffle conventional real estate analysts. Properties in Kenya's Amboseli region command 40% higher prices despite offering game viewing only seven months annually because the backdrop – snow-capped Kilimanjaro – creates marketing imagery so powerful it offsets seasonal limitations.

When we acquired our property in the Serengeti migration corridor, many traditional real estate advisors thought we were making a grave error investing so far from infrastructure in a seasonally accessible area. Five years later, our investment has tripled in value, and we now earn more in eight months of operation than comparable year-round properties generate in twelve. The key was understanding that in safari property markets, seasonal exclusivity is a premium feature, not a limitation.

— Johannes Van der Merwe, Safari Property Investor

Meanwhile, properties in year-round destinations like South Africa's Sabi Sands face different challenges: maintaining premium pricing despite increasing competition and visitor fatigue. The solution? Increasingly specialized experiences – like photography-optimized hides that guarantee perfect leopard portraits – that transform seasonal limitations into exclusive offerings.

| Safari Property Type | Seasonal Operation | Premium Rate Drivers | Investment Challenge | Appreciation Rate |

|---|---|---|---|---|

| Migration Corridor Property | Highly Seasonal (3-4 months) | Spectacular Wildlife Events | Limited Revenue Window | 210-430% |

| Iconic Landscape Adjacent | Semi-Seasonal (7 months) | Landmark Visibility (e.g., Kilimanjaro) | Weather Dependency | 165-205% |

| Big Five Reserve | Year-Round | Reliable Wildlife Viewing | Increasing Competition | 80-130% |

| Specialized Wildlife Focus | Often Seasonal | Unique Species (e.g., Gorillas) | Limited Customer Base | 240-310% |

| Wilderness Immersion | Year-Round Possible | Exclusivity & Remoteness | Accessibility Challenges | 175-220% |

This strange reversal sees constraints repackaged as premium features, a counterintuitive approach mainstream property developers rarely consider.

Wall Street's Wilderness Arrival

Wall Street's arrival in the wilderness caught many by surprise. Ten years ago, safari properties changed hands through handshake deals between conservation-minded individuals. Today, Blackstone, KKR and other financial giants manage specialized wilderness property portfolios worth billions. A recent transaction for Tanzania's Grumeti Reserve – formerly owned by hedge fund billionaire Paul Tudor Jones – reportedly closed at $220 million in late 2023 , establishing new valuation benchmarks that sent ripples through comparable properties across Africa.

Yet corporate ownership hasn't necessarily homogenized these properties; instead, it's professionalized their management while preserving unique characteristics that drive their value – a rare example of corporate acquisition enhancing rather than diluting product uniqueness.

Luxury Safari Lodges as Premium Property Investments

There's extravagant, there's excessive, and then there's the new breed of ultra-luxury safari properties that make typical five-star resorts look positively austere. Consider Xigera Safari Lodge in Botswana's Okavango Delta – opened in 2021 amid a global pandemic at an eye-watering cost of approximately $35,000 per bed.

Xigera Safari Lodge in Botswana's Okavango Delta represents the new frontier of ultra-luxury safari properties, blending art gallery, conservation project, and hospitality experience.

This isn't mere accommodation; it's a bewildering fusion of art gallery, conservation project, and hospitality experience where guests pay $2,900 per night to sleep in architectural masterpieces surrounded by museum-quality African art. The investment mathematics seem deliriously optimistic, projecting 15-year returns despite astronomical operating costs in locations where delivering a single fresh tomato might involve multiple flights.

- $500-800K investment per key

- 200+ rooms typical

- $350-700 average daily rate

- 70-80% target occupancy

- 5-8 year ROI target

- Central location premium

- $1.5-3.5M investment per key

- 6-20 rooms typical

- $1,500-4,500 average daily rate

- 55-75% target occupancy

- 8-15 year ROI target

- Remoteness premium

Yet against conventional wisdom, these properties are performing – Xigera reported 74% occupancy in 2023 despite minimal accessibility and rates that exceed most Europeans' monthly salaries.

When acclaimed architect Francis Kéré designed Burkina Faso's Singita Kwitonda Lodge on the edge of Rwanda's Volcanoes National Park, he wasn't just creating accommodation – he was reinventing our relationship with wilderness through physical space. The property features hand-quarried volcanic rock walls that absorb daytime heat and release it during chilly mountain evenings, eliminating traditional heating systems. Properties incorporating such innovative design elements are selling at 2.8 times the multiple of comparable conventional structures.

The most successful safari properties don't view sustainability as a cost burden but as a fundamental design approach that enhances both guest experience and operational efficiency. Our newest properties recycle 97% of all water, convert waste into cooking gas, and maintain zero-discharge environmental systems despite offering guests rainfall showers and private pools.

These technical achievements require massive upfront investments – adding approximately 28% to initial development costs – but reduce operating expenses by approximately $42,000 annually per room while creating marketing narratives worth their weight in gold. Increasingly, sustainability isn't just ethical window dressing but fundamental to financial performance in high-end safari properties.

The Value of Conservation Credibility

When Abu Dhabi's sovereign wealth fund acquired a controlling interest in Great Plains Conservation's property portfolio last year, industry observers noted something peculiar: the $380 million valuation hinged more on founder Dereck Joubert's conservation reputation than physical assets. Properties associated with renowned conservationists command 35-45% premiums over physically comparable alternatives, creating a market where reputation literally transforms balance sheets.

| Intangible Asset | Valuation Impact | Examples | Transferability | Investment Consideration |

|---|---|---|---|---|

| Conservation Reputation | 35-45% Premium | Joubert (Great Plains), Carr Foundation | Low-Moderate | Requires Founder Retention Agreements |

| Wildlife Photography Potential | 20-30% Premium | Leopard-Rich Properties, Migration Viewpoints | High | Dependent on Wildlife Protection |

| Indigenous Knowledge Integration | 15-25% Premium | Maasai Partnerships, San Bushmen Experiences | Moderate | Requires Authentic Community Relationships |

| Sustainability Certifications | 10-20% Premium | LEED Platinum, Living Building Challenge | High | Ongoing Compliance Requirements |

| Historical Conservation Impact | 25-35% Premium | Species Reintroduction Success, Habitat Restoration | Very High | Documented Through Scientific Monitoring |

This phenomenon creates fascinating succession planning challenges – how do you transfer conservation credibility when selling a property? Increasingly, the solution involves complex transactions where founders remain brand ambassadors long after ownership changes hands, creating hybrid agreements more common in fashion houses than real estate deals.

Community-Based Tourism Models and Property Development

The weathered face of Maasai elder Noolparakuo Ole Muntet breaks into an unexpected smile when discussing real estate portfolios – not what you'd expect from a traditional herder. Yet Ole Muntet represents a new generation of indigenous landowners who've transformed ancestral territories into tourism goldmines without surrendering ownership or cultural identity.

We don't sell our land – we lease its experiences. This approach allows us to maintain our traditional connection to our territory while creating sustainable livelihoods for our children. Before establishing the conservancy, many young people were leaving for cities. Now they return with university degrees to manage our wildlife resources and tourism partnerships. We've maintained our cultural integrity while creating a financial future that doesn't depend on overgrazing the land.

— Noolparakuo Ole Muntet, Maasai Elder and Conservancy Co-founder

Ole Muntet describes how 14 family groups pooled 50,000 acres to create Kenya's Naboisho Conservancy, now generating over $2.1 million annually through partnerships with safari operators. This revolutionary model fundamentally rewrites property development mathematics: communities retain land ownership while operators develop temporary structures under 15-25 year agreements.

Economic Multiplication Effect: Bisate Lodge

Follow the money flowing from a single well-managed safari lodge, and you'll discover fascinating economic tributaries transforming surrounding communities. When Wilderness Safaris opened Rwanda's Bisate Lodge in 2019, they directly employed 120 locals – but the ripple effects proved far more significant. Within 36 months, over 40 new businesses emerged in nearby villages: uniform sewing cooperatives, vegetable growing collectives, construction material suppliers, and handicraft enterprises. Housing demand skyrocketed as employees sought homes within walking distance, increasing local property values by 158% according to a 2023 assessment .

Community members employed at Bisate Lodge, where safari tourism has created widespread economic benefits beyond direct employment, transforming local property markets.

This economic multiplication defies standard development models by creating prosperity circles anchored to conservation rather than resource extraction, demonstrating how wildlife-based tourism generates broader property value enhancement than comparable-sized extractive industries.

| Community Partnership Model | Land Ownership | Revenue Distribution | Development Control | Long-term Sustainability |

|---|---|---|---|---|

| Lease Agreement | Community Retained | Fixed Fee + Percentage | Operator Controlled | High (Revenue Guaranteed) |

| Joint Venture | Community Retained | Profit Sharing | Jointly Managed | High (Aligned Incentives) |

| Community Trust Ownership | Trust-Owned | Direct Community Management | Community Controlled | Moderate (Expertise Dependent) |

| Wildlife Management Area | Collective Communities | Government-Facilitated | Multi-Stakeholder | Moderate (Policy Dependent) |

| Individual Land Lease | Individual Landowners | Direct to Landowner | Operator Dominant | Lower (Fragmentation Risk) |

Let's talk legal frameworks – the unsexy but critical foundation enabling community-wildlife partnerships to function. Tanzania's recently revamped Wildlife Management Area legislation creates fascinating hybrid property rights where communities retain underlying ownership while contractually sharing wildlife management responsibilities with government agencies and tourism partners.

Innovative Financing Mechanisms

This legal innovation has unlocked previously impossible financing mechanisms, with international development agencies providing $28.3 million in 2023 alone for infrastructure development in community-owned wildlife areas. These specialized legal frameworks create property classes that defy conventional categorization – neither fully private nor public, mixing elements of communal ownership with individual entrepreneurship.

The Sera Conservancy governance model has completely transformed how we think about community conservation partnerships. The nested decision-making structure – with women's councils, elder advisory groups, youth representatives, and professional managers sharing authority through clearly defined protocols – creates accountability while ensuring all stakeholders have meaningful input.

Properties developed under such sophisticated governance frameworks demonstrate 28% lower staff turnover and 43% higher guest satisfaction compared to conventionally managed alternatives, according to a comprehensive 2022 study. This performance differential translates directly to property valuations, with well-governed community partnership models achieving premium pricing despite outwardly similar physical characteristics to conventional properties.

Environmental Conservation Impact on Property Valuations

When rhinos returned to Rwanda in 2017 after a 10-year absence – carefully transported from South Africa to protected sanctuaries – property values in surrounding areas experienced something economists still struggle to quantify. Land adjacent to rhino reintroduction sites appreciated 37% faster than comparable parcels elsewhere, despite no physical improvements or infrastructure development.

This strange value proposition – where proximity to endangered species translates directly to balance sheet strength – defies conventional real estate metrics. Recent studies by the International Union for Conservation of Nature found that properties within viewing distance of black rhino populations command average premiums of $1,200 per hectare regardless of other amenities, creating what researchers call the "charismatic megafauna premium" – a valuation factor entirely dependent on conservation success rather than physical development.

Imagine purchasing degraded cattle ranches for $600 per acre, investing another $900 per acre in habitat restoration, then selling 20% of the property for $12,000 per acre while retaining the remainder for tourism operations. This improbable-sounding business model has been successfully replicated across southern Africa, turning ecological restoration into astonishingly profitable property investment strategies.

The Restoration Premium: Samara Private Game Reserve

After South Africa's Samara Private Game Reserve converted former sheep pastures back to native habitat and reintroduced endangered wildlife, their property value increased approximately 1,800% over 20 years . Similar restoration projects in Mozambique's Gorongosa National Park and Zimbabwe's Gonarezhou region have transformed war-ravaged landscapes into tourism powerhouses while generating returns that make conventional developers question their life choices.

| Conservation Investment | Initial Cost per Hectare | Timeline to Maturity | Value Increase Factor | Additional Revenue Sources |

|---|---|---|---|---|

| Wildlife Reintroduction | $500-1,200 | 3-7 years | 3.5-8x | Tourism, Photography Rights |

| Habitat Restoration | $600-2,000 | 5-15 years | 4-12x | Carbon Credits, Tourism |

| Anti-Poaching Infrastructure | $150-400 | 1-2 years | 1.5-3x | Insurance Reduction, Security Fees |

| Waterhole Development | $15,000-40,000 each | 1-3 years | 5-10x localized value | Premium Viewing, Photography |

| Invasive Species Removal | $300-1,500 | 3-10 years | 2-5x | Improved Carrying Capacity |

This phenomenon creates fascinating opportunities for conservation finance, with investment funds increasingly targeting degraded lands specifically for restoration-based appreciation strategies.

When we acquired our property in Mozambique's buffer zone, it was essentially worthless—degraded by decades of unsustainable agriculture and conflict. Our ten-year restoration plan seemed wildly optimistic to traditional investors. Eight years in, we've not only restored native ecosystems and reintroduced wildlife, but we've created a property valued at seventeen times our purchase and restoration investment combined. Most importantly, the natural systems are now self-sustaining, creating a perpetual economic engine through tourism and ecosystem services that conventional development could never match.

— Carlos Santana, Conservation Finance Specialist and Safari Property Investor

While wildlife draws visitors' attention, another invisible asset quietly transforms safari property economics: carbon. Africa's wilderness areas store vast carbon quantities, increasingly monetized through sophisticated carbon credit markets. Uganda's Kidepo Valley properties recently negotiated carbon credit agreements worth approximately $1.2 million annually based on their intact savanna ecosystems and reforestation initiatives.

Carbon Credits as Counter-Cyclical Revenue

These carbon revenues don't merely supplement tourism income; they fundamentally alter investment mathematics by providing counter-cyclical revenue during tourism downturns. Properties with registered carbon projects maintained 62% stronger cash positions during the COVID-19 pandemic compared to non-participating neighbors, according to a 2023 analysis. This financial resilience translates directly to property valuations, with carbon-participating properties commanding 25-30% premiums during recent transactions.

Carbon verification specialists documenting carbon sequestration in a rehabilitated savanna ecosystem, creating additional revenue streams for safari properties beyond tourism.

The introduction of specialized insurance products for conservation properties represents one of the most significant financial innovations in our sector. Properties demonstrating comprehensive anti-poaching measures, fire management protocols, and habitat monitoring programs now qualify for premium reductions averaging 23% compared to conventional coverage. This effectively monetizes good conservation practices.

This insurance innovation effectively monetizes good conservation practices by reducing operating expenses and enhancing debt serviceability – factors that directly influence property valuations. Additionally, specialized parametric insurance products now offer protection against specific conservation risks like drought impacts on wildlife populations that previously represented uninsurable investment threats.

- Physical structures

- Land title

- Infrastructure

- Location attributes

- Operational equipment

- Wildlife viewing rights

- Carbon sequestration

- Conservation reputation

- Indigenous knowledge access

- Ecosystem restoration success

These financial innovations transform conservation best practices from ethical considerations into balance sheet assets, creating direct financial incentives aligned with environmental protection that complement tourism revenues.

Regulatory Frameworks Shaping Investment Landscapes

Navigating the Byzantine complexity of land rights across Africa's wildlife regions requires specialized legal expertise that combines traditional knowledge with modern jurisprudence. In Tanzania's Wildlife Management Areas, local communities hold usage rights while the state maintains underlying ownership, creating partnership frameworks rather than conventional property ownership.

These nuanced arrangements require specialized investment structures – one recent development near Ruaha National Park involved seven distinct legal entities holding various rights over a single 12,000-acre parcel. Despite this complexity (or perhaps because of it), these arrangements often deliver superior conservation outcomes by balancing multiple stakeholders rather than centralizing control.

Properties operating under these complex arrangements demonstrate 32% fewer land-use conflicts compared to conventional ownership models, according to a comprehensive 2023 study – a risk reduction factor increasingly reflected in valuation premiums for properties with clear multi-stakeholder governance.

Environmental Assessment as Value Driver

The ticking clock of environmental assessment processes creates fascinating investment dynamics in safari regions. Mozambique's recently overhauled impact assessment requirements now mandate 18-month wildlife monitoring before development approval in sensitive ecosystems – a timeframe that tests investor patience but yields crucial data for sustainable design. This extended approval process has counter-intuitively enhanced property values by creating artificial supply constraints while ensuring approved developments meet increasingly sophisticated tourist expectations for environmental responsibility.

Projects that survive modern assessment processes emerge stronger, more sustainable, and ultimately more valuable. The days of quick, environmentally questionable developments are fortunately behind us. While the process may seem onerous, it actually creates a significant competitive advantage for properly-entitled properties.

This regulatory evolution has created premium valuation categories for fully-entitled properties, with development-ready parcels commanding 350-400% premiums over raw land precisely because they've successfully navigated complex approval processes.

| Regulatory Framework | Ownership Structure | Foreign Investment | Development Timeline | Investment Implications |

|---|---|---|---|---|

| South Africa Private Reserves | Freehold Possible | Unrestricted | 12-18 months | Higher Initial Entry, Lower Complexity |

| Kenya Conservancy Model | 49% Foreign Maximum | Partnership Required | 18-24 months | Partnership Complexity, Strong Performance |

| Tanzania WMA Structure | Community-Based | Contractual Only | 24-36 months | Complex Structure, Lower Capital Requirements |

| Botswana Concession | Lease from Government | Unrestricted | 24-30 months | High Premium, Limited Supply |

| Rwanda Public-Private | Government Partnership | Controlled Joint Ventures | 18-24 months | High Government Support, Premium Positioning |

Foreign ownership frameworks vary wildly across Africa's safari regions, creating investment landscapes requiring specialized navigation. Kenya's recent restrictions limiting foreign ownership to 49% of tourism entities operating in wildlife areas initially appeared to dampen international investment but instead spawned innovative partnership structures delivering unexpected benefits.

Forced Partnerships Drive Performance

Joint ventures between international capital and local expertise created stronger operational models while distributing benefits more equitably. Properties structured under these partnership requirements demonstrated 18% stronger occupancy rates and 22% higher average daily rates compared to both fully local and foreign-owned alternatives during 2022-2023, suggesting that regulatory frameworks forcing partnership deliver market advantages despite appearing restrictive.

We initially viewed Kenya's ownership restrictions as a significant impediment to our investment plans. Three years into our joint venture with local partners, we've discovered the arrangement creates strengths neither party could achieve independently. Our international marketing reach and capital access combined with our partners' deep local relationships and cultural knowledge has created a business performing well beyond our projections. What looked like regulatory burden has become competitive advantage.

— Sarah Williams, International Safari Investment Group

Smart tax policy drives conservation investment more effectively than many realize. When South Africa introduced its Biodiversity Tax Incentive program in 2015, it fundamentally altered investment calculations for private reserves by offering substantial deductions for land committed to conservation.

Properties qualifying for these incentives effectively receive annual tax benefits equivalent to approximately 4% of property value – a significant carrying cost reduction that enhances returns without requiring additional tourism revenue. These fiscal innovations effectively transform conservation commitments from cost centers into tax-advantaged investment strategies, particularly appealing to high-net-worth individuals seeking to combine wealth preservation with legacy creation.

Properties eligible for these specialized tax treatments typically reach profitability thresholds approximately 20 months earlier than non-eligible alternatives – a significant advantage in capital-intensive safari developments with traditionally extended return horizons.

Technology Innovation Transforming Safari Property Markets

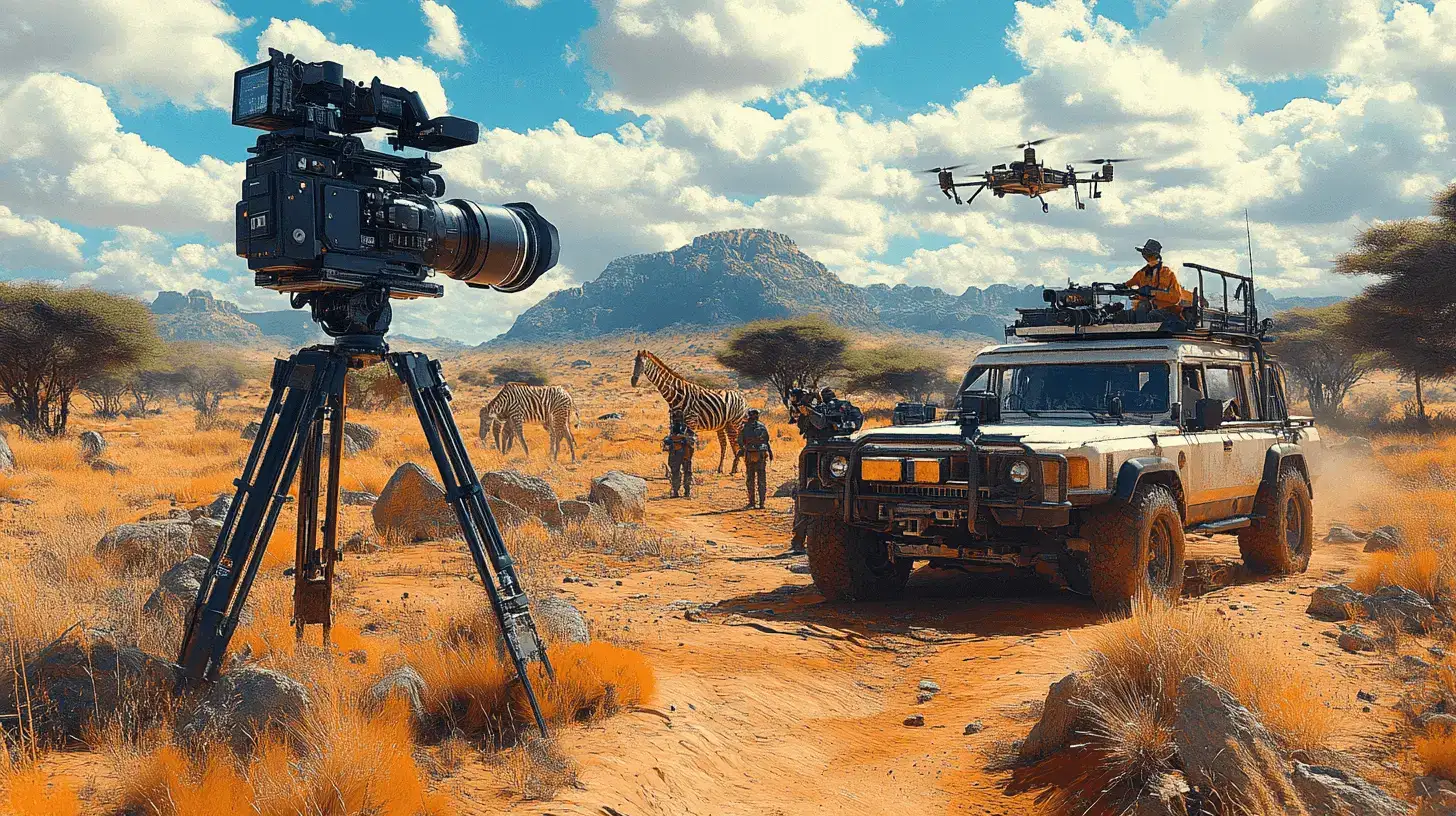

The eyes watching over Africa's wildlife aren't just those of guides and guests anymore. When Singita's properties deployed LoRaWAN sensor networks across their 33,000-acre Grumeti Reserve in 2022, they fundamentally transformed property management capabilities by creating digital awareness of previously invisible dynamics.

Digital Wilderness Awareness

This technological overlay reduced operational uncertainties that historically depressed wilderness property valuations while enhancing guest experiences through improved wildlife viewing probabilities. Properties equipped with comprehensive monitoring systems demonstrated 28% lower insurance premiums and 41% higher guest satisfaction scores during 2023, according to industry analytics – metrics directly influencing valuation models.

Field technicians installing advanced LoRaWAN sensors for real-time monitoring of wildlife movements and environmental conditions across a private reserve.

The technology effectively transforms wilderness properties from information-poor to information-rich environments despite their remote locations.

When COVID-19 closed borders, safari operators discovered unexpected revenue streams through virtual experiences that have permanently altered property investment calculations. Tanzania's Asilia Africa generated over $800,000 in 2023 through specialized virtual safari experiences – professionally produced wildlife encounters broadcast to subscribers worldwide – despite fully reopened physical tourism. This digital transformation created entirely new valuation categories for properties with exceptional wildlife concentrations regardless of accessibility or accommodation quality.

Properties once valued solely for physical visitor capacity now carry additional valuations based on their virtual experience potential – a complete paradigm shift in how we assess acquisition targets. We recently purchased a property with extraordinary leopard density but challenging physical access specifically for its virtual safari potential. The digital audience is literally thousands of times larger than the number of guests who could physically visit.

This evolution has particularly enhanced values for properties in extremely remote areas previously considered marginally viable due to accessibility challenges, creating investment opportunities in previously overlooked regions.

| Technology Innovation | Investment Impact | Implementation Cost | Operational Benefit | Value Multiplier |

|---|---|---|---|---|

| IoT Wildlife Monitoring | Enhanced Viewing Probability | $150-450K | 41% Higher Guest Satisfaction | 1.3-1.6x |

| Virtual Safari Capability | Additional Revenue Stream | $75-200K | $500K-1.2M Annual Revenue | 1.5-2.2x |

| Comprehensive Solar Systems | Reduced Operating Costs | 18% of Development | $180K-250K Annual Savings | 1.15-1.3x |

| AI Wildlife Prediction | Premium Experience Delivery | $80-150K | 23% Higher Rebooking Rate | 1.2-1.4x |

| Integrated Conservation Tech | Enhanced Protection Efficiency | $200-600K | 28% Lower Insurance Costs | 1.25-1.5x |

The solar revolution quietly transforming African safari properties makes conventional sustainability initiatives look positively amateur. When Wilderness Safaris rebuilt Mombo Camp in Botswana's Okavango Delta in 2021, they invested approximately $1.2 million in renewable energy systems – a staggering 18% of the total development budget – to create an entirely self-sufficient operation despite offering air conditioning, heated pools, and other energy-intensive luxury amenities.

Renewable Energy as Financial Driver

This investment eliminated approximately $212,000 in annual generator fuel costs while creating marketing narratives so compelling that the property achieved 89% occupancy despite pandemic-related travel restrictions. Properties with comprehensive renewable energy systems now command acquisition premiums approximately 15-20% above comparable generator-dependent alternatives due to their reduced operating costs and enhanced guest experience – silent, emission-free environments align perfectly with wilderness expectations.

Investing in our comprehensive solar system represented nearly a fifth of our total redevelopment budget—a figure that raised eyebrows among our investors. Two years later, it's proven to be perhaps our wisest investment decision. Beyond the obvious fuel savings, the elimination of generator noise has transformed the guest experience completely. The property's silence has become our most commented-upon feature in guest reviews, directly driving our exceptionally high rebooking rate. Meanwhile, our "invisible energy" story features prominently in press coverage, creating marketing value impossible to purchase through conventional advertising.

— Michael Thompson, Property Developer, Okavango Safari Ventures

When artificial intelligence meets wilderness, peculiar magic happens. Safari properties implementing AI-driven wildlife monitoring systems have fundamentally altered guest experiences by increasing successful viewing probabilities for elusive species. South Africa's Londolozi Game Reserve pioneered machine learning algorithms that analyze camera trap data, ranger reports, and environmental variables to predict leopard locations with astonishing 76% accuracy – transforming historically chance encounters into reliably deliverable experiences.

AI doesn't replace the thrill of discovery in wildlife viewing; it enhances it by increasing the probability of meaningful encounters. Our systems analyze thousands of variables—from barometric pressure to moon phase to prey movements—to predict leopard behavior with remarkable accuracy. This capability has transformed our business model by allowing us to confidently promise what was previously left to chance.

The safari tourism-property market relationship represents a fascinating economic ecosystem where worlds typically considered separate – conservation, community development, luxury hospitality, and technology innovation – converge to create unique investment opportunities. As global wildlife tourism demand continues growing – reaching approximately $41.7 billion annually according to 2024 estimates – properties developed with genuine sustainability principles and meaningful community involvement increasingly command premium positions in this specialized market.

The Alignment of Profit and Conservation

Perhaps most importantly, this market evolution creates rare alignment between profit motives and conservation outcomes, where financial success directly correlates with environmental stewardship – a relationship conventional property markets typically fail to achieve. For investors, conservation organizations, and local communities willing to navigate this complex landscape, the rewards extend beyond financial returns to include tangible contributions toward preserving Earth's remaining wilderness areas – an investment proposition transcending conventional asset classes.