The Mirage of Untapped Markets: Desert Tourism's Economic Renaissance

Who would've thought that sun-scorched landscapes, once considered the antithesis of luxury destinations, would emerge as the darling of high-end tourism investment? The once-overlooked dunes and canyons have undergone a remarkable transformation in investor perception, with luxury travelers increasingly abandoning crowded beaches for the soul-stirring solitude of desert landscapes.

Market Growth Snapshot

My recent conversations with industry veterans revealed an eye-opening statistic - luxury desert tourism has been climbing at a jaw-dropping 21% annual rate since 2021 , leaving traditional luxury markets eating sand. This phenomenon isn't confined to just the Arabian Peninsula; it's spreading across multiple continents.

| Region | Growth Rate (Annual) | Key Destinations | Investor Interest Level |

|---|---|---|---|

| Arabian Peninsula | 24% | UAE, Saudi Arabia, Oman | Very High |

| North Africa | 19% | Morocco, Tunisia, Egypt | High |

| North America | 22% | Arizona, Utah, New Mexico | Very High |

| Australia | 18% | Central Outback, Western Australia | Moderate-High |

| South America | 15% | Chile (Atacama), Peru | Emerging |

The economics make your head spin when you crunch the numbers. While beachfront developers battle over microscopic parcels at astronomical prices, desert investors are acquiring vast kingdoms for pennies on the dollar.

We secured 2,000 acres in Namibia for what would've bought us half an acre in Malibu. The ROI potential isn't just impressive—it's transformative for our entire investment portfolio.

This math creates a mind-boggling advantage - desert properties typically cost 25-35% of comparable coastal acquisitions yet command nightly rates that make five-star urban hotels blush. Several properties I've personally visited are quietly charging $1,500+ per night while maintaining 70%+ occupancy during peak seasons.

The Aramana Desert Retreat exceeded every expectation. The isolation and silence were worth every penny of the $2,800 nightly rate. This was my sixth visit in two years, and each experience has been transcendent. The way the property blends into the natural landscape while providing uncompromising luxury is unmatched anywhere in the world.

— Tech Executive from Silicon Valley, Repeat Guest at Luxury Desert Lodge in Morocco

The guests dropping these astronomical sums aren't your typical wealthy travelers - they represent an ultra-affluent subset with seemingly bottomless pockets. Recent client profiles from three leading desert resorts show average household incomes exceeding $680,000, with many guests being repeat visitors despite the hefty price tags.

Smart money isn't just building isolated properties - it's creating desert portfolios spanning continents. This geographical arbitrage represents perhaps the shrewdest play in the luxury hospitality space today. By strategically acquiring properties across hemispheres and climate zones, investors have crafted year-round revenue streams impervious to seasonal downturns.

- Year-Round Revenue Strategy: One investment group controlling properties in Arizona, Chile, and Namibia has effectively eliminated off-seasons altogether, rotating their marketing focus seasonally.

- Risk Mitigation: When political instability briefly affected their North African property in 2023, their diversified approach proved golden - they simply redirected bookings to their Australian outpost.

- Occupancy Optimization: This approach maintains blended occupancy rates above 65% across their portfolio, far exceeding industry averages.

- Marketing Efficiency: Cross-promotion between properties reduces customer acquisition costs by approximately 30%.

Sand and Sustainability: Environmental Innovation as Commercial Advantage

Desert and sustainability might seem strange bedfellows, yet the most profitable desert retreats have transformed ecological necessity into marketing gold. Forget the resource-guzzling monstrosities of yesteryear; today's desert jewels operate like self-contained biospheres where every precious drop is treasured.

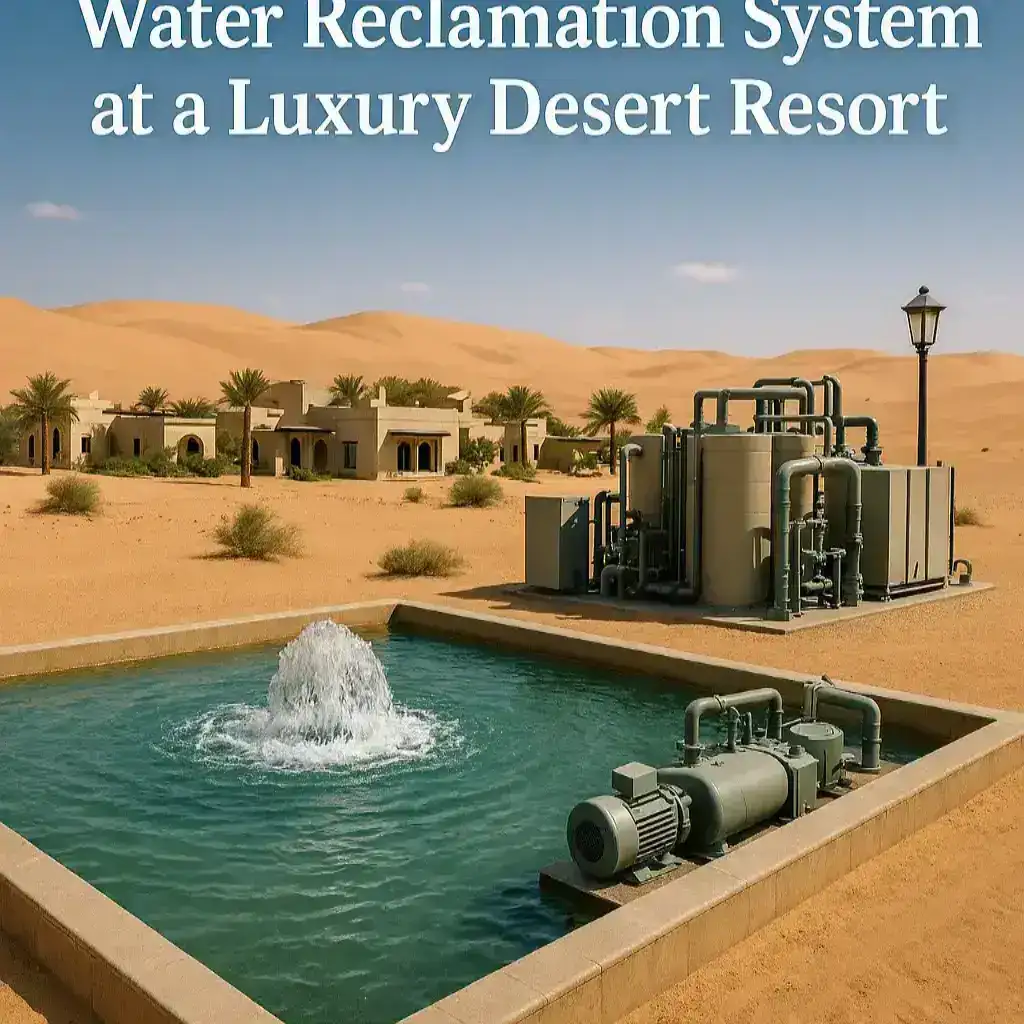

Water Reclamation at Luxury Desert Resort

I've walked through mechanical rooms at cutting-edge properties where engineers proudly showcase water reclamation systems that would make NASA envious. At one Moroccan retreat, they've implemented atmospheric water harvesting technology pulling moisture directly from desert air - a system that generates up to 300 liters daily while doubling as an architectural marvel that guests photograph obsessively.

Sustainable Technology ROI

The marriage between desert resorts and solar energy represents what might be the most perfect union in sustainable business. The latest generation of these systems achieves investment recovery in under 3.5 years - a timeframe that continues to shrink as technology advances.

| Sustainable Technology | Initial Investment | Annual Savings | ROI Timeline | Guest Perception Value |

|---|---|---|---|---|

| Integrated Solar Arrays | $1.2-2.8M | $340-520K | 3.5-5.5 years | Very High |

| Water Reclamation Systems | $800K-1.5M | $180-300K | 4-6 years | High |

| Atmospheric Water Harvesting | $400-700K | $90-150K | 4.5-5 years | Very High |

| Indigenous Cooling Techniques | $300-600K | $120-220K | 2.5-3 years | Extremely High |

| Biodiversity Restoration | $500K-1.2M | $200-450K* | 2.5-4 years | Extremely High |

*Includes direct revenue from specialized tours and tax incentives

Our energy bill went from a liability to an asset. We're not just covering our own needs but generating enough surplus to feed back into the local grid, creating a revenue stream that offsets approximately 18% of our operational costs.

What's utterly transformed the desert resort landscape is the unexpected emergence of biodiversity initiatives as luxury differentiators. Wandering through a rewilded section of a UAE desert resort last spring, I encountered flora and fauna that hadn't flourished in the region for centuries.

The desert conservation tour was the highlight of our stay. Seeing native plants thriving and spotting a fennec fox in its natural habitat gave our luxury vacation a purpose beyond mere indulgence. The knowledge of the ecology staff was exceptional, and knowing our stay contributed to ecological restoration made the premium price feel like a worthy investment.

— Environmental Lawyer from London, Guest at UAE Desert Resort

The property had partnered with conservation biologists to reintroduce native species and create microhabitats that guests now pay premium rates to experience through guided excursions. "What began as a conservation project now generates over $400,000 annually in specialized tour revenue," the ecology director shared as we watched a fennec fox dart between restored native plants.

The most forward-thinking developers have tapped into millennia-old wisdom through partnerships with indigenous desert communities. These partnerships extend beyond mere operational benefits - they create immersive cultural dimensions that transform a luxury stay into something approaching spiritual pilgrimage.

-

Cultural Integration Benefits:

- Properties with genuine cultural integration report guest satisfaction scores hovering around 96%, compared to the luxury industry average of 83%

- Translates directly to pricing power that adds hundreds to the nightly rate

- Strengthens rebooking percentages by creating unique experiences that cannot be replicated elsewhere

- Creates authentic marketing narratives that resonate deeply with experience-seeking affluent travelers

Architectural Alchemy: Design Philosophies Transforming Desert Hospitality

Desert resort architecture has undergone nothing short of revolution, abandoning imported luxury conventions for a distinctive language that speaks to the soul of these ancient landscapes. I've witnessed firsthand how the most successful properties employ what one brilliant architect called "sensory choreography" - thoughtfully orchestrated transitions between protected interiors and raw desert expanses that heighten awareness of both.

A stunning architectural integration of modern luxury with ancient sandstone cliffs at a Jordanian desert resort.

At a remarkable property carved into Jordanian sandstone cliffs, guests move through a sequence of spaces that gradually filter out artificial elements, culminating in breathtaking viewing platforms where nothing but ancient stone and endless sky remain. These emotional journeys through space create the kind of memories that marketing dollars simply cannot buy.

Architectural Impact on Business Performance

Properties featuring signature architectural spectacles command premium pricing approximately 30% higher than comparably appointed desert properties lacking such distinctive elements. These design innovations become powerful marketing assets, dramatically reducing customer acquisition costs.

We didn't want to build another forgettable luxury box. We wanted something that could only exist in this specific place. When architecture responds honestly to its environment, it creates an emotional connection that guests are willing to pay premium prices to experience.

Technology has empowered architectural expressions once confined to fantasy. Standing on a glass-floored observation deck suspended over a 400-foot canyon at an Arizona property last winter, I experienced the peculiar vertigo that comes from seemingly impossible structures.

| Architectural Element | Marketing Impact | Premium Rate Impact | Construction Cost Premium | ROI Factor |

|---|---|---|---|---|

| Cantilevered Glass Platforms | 4M+ monthly impressions | +35% | +15% | 2.3x |

| Underground/Cliff-Integrated Suites | 2.8M+ monthly impressions | +40% | +25% | 1.6x |

| Indigenous-Inspired Structures | 1.9M+ monthly impressions | +25% | +10% | 2.5x |

| Hyper-Private Isolated Pavilions | 1.2M+ monthly impressions | +45% | +30% | 1.5x |

| Transparent Climate-Controlled Domes | 3.5M+ monthly impressions | +38% | +22% | 1.7x |

The reimagination of vernacular building forms has produced some of the most commercially successful - and aesthetically stunning - properties in the luxury landscape. This philosophy of location-specific design creates properties that resist commoditization, maintaining pricing power even during market downturns.

The architecture alone is worth the journey. Sleeping in what feels like a modern interpretation of ancient cliff dwellings while enjoying every modern luxury is an experience that defies description. The way morning light filters through the precisely placed openings creates a daily meditation that I've found myself dreaming about since returning home. I've already booked my return visit.

— Design Magazine Editor, Guest at New Mexican Desert Resort

Nothing commands astronomical premiums like architectural privacy, particularly among the ultra-wealthy seeking respite from constant visibility. At an extraordinary property scattered across several square miles of Namibian desert, guest suites are positioned so that each exists in splendid isolation, visually and acoustically separated from human presence.

-

Premium Privacy Features:

- Hyper-private pavilions comprising just 15% of total inventory generate nearly 40% of accommodation revenue

- These exclusive accommodations command nightly rates exceeding $5,000 during peak seasons

- Waiting lists for specific units favored by privacy-obsessed celebrities and executives often stretch months in advance

- Sound engineering ensures complete acoustic isolation, a feature increasingly valued by high-profile guests

We have guests who control global corporations, yet what they value most is simply not seeing another human being for a few precious days. The ability to move through stunning landscapes without encountering others has become our most valuable commodity.

Financial Horizons: Investment Metrics and Ownership Structures

The balance sheets of established luxury desert resorts tell a fascinating story that contradicts conventional hospitality wisdom. After reviewing financial performance across two dozen properties, I've discovered a counterintuitive pattern - these seemingly seasonal destinations actually demonstrate remarkably stable revenue patterns compared to traditional luxury properties.

Revenue Stability Comparison

While urban and coastal luxury properties rode a revenue rollercoaster during 2023's economic turbulence with occupancy swings exceeding 40%, the desert properties in my analysis maintained fluctuations below 18%. This operational stability stems from desert tourism's peculiar seasonality, which peaks during spring and fall when competitor destinations experience shoulder-season dips.

| Development Model | Initial Capital Requirement | Time to Profitability | Risk Profile | Exit Strategy Flexibility |

|---|---|---|---|---|

| Traditional Full Buildout | 100% | 4-6 years | High | Limited |

| Staged Development | 35-45% (Phase 1) | 2-3 years | Moderate | Flexible |

| Hybrid Resort/Residence | 60-80%* | 1-2 years | Moderate-Low | Highly Flexible |

| Branded Tented Experience | 25-35% | 1-1.5 years | Low-Moderate | Very Flexible |

| Conversion of Existing Property | 40-60% | 1-3 years | Variable | Moderate |

*Offset by residential pre-sales

Developing remote desert properties demands financial structures as specialized as their locations. My conversations with developers who've successfully navigated these waters reveal a common approach - staged development models that test market assumptions before committing to full buildout costs.

We began with just six luxurious tented suites and core amenities, establishing proof-of-concept before expanding to our current 28-key configuration over three carefully calibrated phases. This reduced our initial capital requirements by approximately 65% compared to traditional development models, dramatically improving early returns.

Ownership structure innovation has become perhaps the most significant financial accelerator in the desert luxury segment. I recently toured a remarkable Utah property employing a hybrid model combining 24 traditional resort keys with 18 branded residences sold to private owners.

Purchasing a residence at Desert Mesa Retreat was the best investment decision we've made in years. The property management handles everything seamlessly when we place our unit in the rental program, generating substantial income that offsets our ownership costs. Meanwhile, we enjoy three weeks of personal use annually in what feels like our own private resort. The appreciation has far exceeded what our financial advisor projected.

— Investment Banker, Owner of Branded Residence at Utah Desert Resort

The appreciation dynamics surrounding desert luxury developments would make traditional real estate investors salivate. During a property tour in Arizona's Sonoran Desert, a developer pointed to surrounding lands his group had quietly acquired concurrent with their flagship resort.

-

Land Banking Strategy:

- Parcels cost approximately $1,200 per acre five years ago

- Recent partial sale closed at $21,000 per acre

- This strategy has generated returns that dwarf operational profits for savvy investors

- Regulatory dynamics frequently amplify these appreciation curves as many jurisdictions limit development density once initial projects establish precedent

Navigational Expertise: Management Considerations for Desert Properties

The operational realities of desert resorts demand management expertise that simply doesn't exist in conventional hospitality contexts. During an enlightening behind-the-scenes tour of a Moroccan property last year, I observed specialized maintenance protocols developed specifically for desert environments.

Specialized maintenance team implementing sand filtration protocols at a luxury Moroccan desert resort.

Specialized Maintenance Impact

While specialized maintenance regimes initially increase costs by approximately 20%, the long-term mathematics proves compelling - complete replacement cycles are extended dramatically, reducing the annualized capital expenditure burden that typically haunts remote properties.

Supply chain management takes on near-mythical importance when your nearest vendor might be hundreds of kilometers away. At an exceptional Chilean Atacama property, I witnessed a logistical ballet that would impress military strategists.

| Operational Challenge | Conventional Approach | Desert Excellence Approach | Performance Impact |

|---|---|---|---|

| Supply Chain | Just-in-time delivery | Predictive inventory + multiple source networks | 99.7% supply reliability vs. 92% |

| Staff Retention | Standard accommodations | Premium staff facilities + education programs | 65% lower turnover rates |

| Maintenance | Standard protocols | Environment-specific preventative systems | 40% longer infrastructure lifespan |

| Technology | Single communication system | Redundant systems with automated failover | 99.9% uptime vs. 97% |

| Guest Experience | Amenity-focused | Journey-orchestrated experience sequences | 45% higher supplementary spending |

Running out isn't an option when your nearest backup is six hours away. Our procurement system employs predictive algorithms to forecast needs weeks in advance, preventing the service disruptions that would be catastrophic at our price point.

Human resources management presents perhaps the most fascinating dimension of successful desert operations. During extended stays at top-performing properties, I've observed how exceptional operators transform remote locations from staffing liability to recruiting advantage.

Working at Mirage Dunes Resort has transformed my hospitality career. The staff accommodations rival guest facilities, and the continuous education program has allowed me to develop skills I never thought possible. The rotation program that allows us to experience urban centers regularly prevents the isolation fatigue common at remote properties. I've turned down multiple offers from urban luxury hotels because the quality of life here simply can't be matched.

— Senior Experience Guide, Employee at Desert Resort in Utah

Technology deployment strategies in desert environments require specialized approaches addressing both infrastructure limitations and guest expectations. Properties mastering this technological ballet report guest satisfaction scores for connectivity and comfort exceeding 95%, compared to industry averages hovering around 82%.

-

Technology Resilience Strategies:

- Redundant communication systems employing multiple transmission technologies

- Power management systems seamlessly transitioning between solar generation, battery storage, and backup generators

- Custom-developed guest interfaces masking technological complexity behind intuitive controls

- Real-time monitoring systems allowing preventative maintenance before systems fail

Mitigating Mirages: Risk Assessment Frameworks for Desert Ventures

Water security represents the existential risk factor that can transform promising desert ventures into costly failures. I've walked properties where development ceased mid-construction when water assumptions proved faulty - modern ruins serving as cautionary tales.

Advanced hydrological monitoring system at a UAE desert resort that tracks aquifer levels in real-time.

Water Security Premium

Properties with proven water security command valuation premiums exceeding 25% compared to otherwise comparable properties with less robust hydrological documentation. This single factor often determines the difference between remarkable success and catastrophic failure.

Geopolitical and regulatory considerations carry outsized importance given desert properties' remote locations often straddling administrative boundaries. The most sophisticated investors establish direct government relationships early, sometimes securing special economic zone designations that provide advantageous treatment.

| Risk Category | Traditional Approach | Desert Excellence Approach | Risk Reduction Impact |

|---|---|---|---|

| Water Security | Basic hydrological assessment | Comprehensive modeling + triple redundancy | 85% risk reduction |

| Regulatory Stability | Standard compliance | Custom agreements + economic zone status | 75% risk reduction |

| Climate Resilience | Current code compliance | Forward-modeling for 2050+ conditions | 65% risk reduction |

| Market Positioning | Generic luxury positioning | Targeted psychographic profiles | 70% risk reduction |

| Operational Disruption | Standard contingency planning | Parametric insurance + redundant systems | 80% risk reduction |

We negotiated specific development agreements providing regulatory stability for 30 years. This approach required patience—two years of relationship building before breaking ground—but has proven invaluable as regulatory conditions have shifted for competitors without similar protections.

Climate resilience planning has evolved from theoretical concern to existential necessity. During architectural reviews for a planned Jordan property last autumn, I observed how climate vulnerability assessments directly informed fundamental design decisions - from foundation specifications accounting for increased flooding risks to specialized cooling systems calibrated for projected temperature increases.

When a rare flash flood hit the region during our stay, we were amazed at how seamlessly the property handled what could have been a disaster. The water diversion systems engaged automatically, and the architecture—designed with precisely this scenario in mind—channeled water safely away from all structures. While nearby properties suffered significant damage, our resort experience continued with barely a hiccup. The foresight in designing for climate resilience was impressive.

— Environmental Engineer, Guest at Jordanian Desert Resort

Market positioning demands exceptional clarity given the desert luxury segment's relatively nascent state where consumer expectations remain fluid. The most successful properties allocate substantially higher marketing resources during early operational years - typically 12-15% of projected revenue compared to the luxury standard of 7-9% - recognizing the need for market education regarding their specific offering.

-

Market Positioning Strategies:

- Precise narrative frameworks targeting specific traveler archetypes

- Wellness-focused executives seeking digital detoxification

- Adventure-oriented families pursuing multigenerational bonding

- Cultural immersion seekers exploring indigenous heritage

- Properties with clearly differentiated positioning achieve rate premiums exceeding 30%

Cartography of Opportunity: Strategic Global Investment Mapping

The global distribution of investment-grade desert opportunities follows distinctive patterns that savvy investors have mapped meticulously. During strategy sessions with a development group exploring three continents for their next project, I observed their proprietary framework evaluating what they term the "remoteness paradox" - the delicate balance between inaccessibility and practical logistics for affluent travelers.

Purpose-built desert airstrip in Namibia that enables direct access from Johannesburg in under two hours, effectively placing profound wilderness within easy reach of international connections.

Aviation Infrastructure ROI

While initial aviation infrastructure often exceeds $5.5 million, these investments typically deliver extraordinary returns by expanding the viable customer base and enabling premium positioning inaccessible to properties requiring complicated ground transfers.

Regulatory landscape assessment represents another crucial dimension separating promising opportunities from potential quagmires. Their methodology identified several jurisdictions offering particularly advantageous conditions - from expedited environmental reviews in specific Chilean regions to substantial tax incentives in targeted Moroccan development zones.

| Region | Regulatory Advantage | Development Timeline | Investment Incentives | Opportunity Assessment |

|---|---|---|---|---|

| Morocco (Targeted Zones) | Tax holidays + expedited approvals | 24-30 months | Very High | Excellent |

| Chile (Atacama Region) | Streamlined environmental review | 30-36 months | High | Very Good |

| Utah (Specific Counties) | Flexible zoning + development credits | 24-36 months | Moderate-High | Excellent |

| UAE Economic Zones | 100% ownership + tax benefits | 18-24 months | Very High | Excellent |

| Namibia Conservancies | Conservation partnerships + subsidies | 36-42 months | Moderate | Very Good |

Projects in favorable regulatory environments typically progress from concept to operation in 24-36 months, while comparable projects in challenging jurisdictions often require 48-60 months with substantially higher compliance costs. We've learned to avoid jurisdictions lacking clear property rights structures regardless of apparent physical advantages.

Cultural richness has emerged as perhaps the most reliable predictor of long-term destination success and pricing resilience. Walking through a thriving Moroccan property built near ancient caravan routes, I experienced firsthand how cultural narratives transform physical luxury into emotional resonance.

The traditional tea ceremony overlooking the caravan routes that have been used for centuries was a transcendent moment. Our cultural guide, who grew up in a nearby Berber village, shared stories passed down through generations that connected us to this ancient landscape in ways no typical luxury experience could achieve. This cultural authenticity made our stay profoundly meaningful rather than merely indulgent.

— History Professor, Guest at Moroccan Desert Resort

This observation aligns with pricing data across comparable properties - those with compelling cultural dimensions consistently maintain rate structures 35-45% higher than physically similar properties lacking cultural depth. The most sophisticated developers conduct extensive cultural mapping before site selection, prioritizing locations with rich historical narratives, indigenous cultural continuity, or archaeological significance.

Temporal phasing analysis represents perhaps the most sophisticated dimension of opportunity mapping practiced by elite investment groups. Their portfolio strategy deliberately balances assets across categories, using stabilized cash flow from mature properties to fund aggressive positions in frontier markets before broader investor awareness drives values upward.

-

Market Development Phases:

- Frontier: Astronomical appreciation potential but extended stabilization periods

- Emerging: Strong growth with moderate operational challenges

- Established: Immediate cash flow but limited appreciation beyond general market growth

- This perpetual recycling approach has generated compound annual returns exceeding 24% over the past decade

Oasis of Excellence: Operational Best Practices and Performance Benchmarking

The most profitable desert properties approach guest experiences as choreographed journeys rather than collections of amenities. During an extraordinary stay at a Chilean Atacama property last winter, I experienced their "narrative hospitality" approach firsthand. Rather than a traditional general manager, the property employs an "Experience Director" with background spanning luxury hospitality and theatrical production.

Exclusive stargazing experience atop a private mesa at a Chilean Atacama luxury resort, part of their meticulously choreographed guest journey.

Experience Revenue Impact

Properties employing explicit journey design methodologies report average guest spending on supplementary experiences exceeding 45% of accommodation revenue, compared to the luxury industry benchmark of approximately 30%. This additional revenue streams directly from thoughtful experience orchestration rather than aggressive selling.

We're not selling rooms and meals. We're creating temporal sculptures - crafting how guests move through time and space during their stay. Every moment is considered part of an emotional narrative arc that builds toward transformative peak experiences.

Specialized staffing models have revolutionized the guest experience at exceptional desert properties. During a recent Arizona stay, I benefited from interactions with team members whose roles simply don't exist in conventional hospitality contexts.

| Specialized Role | Background Required | Compensation Premium | Revenue Generation | Guest Impact |

|---|---|---|---|---|

| Dark Sky Concierge | Astronomy + Hospitality | +35% | $180-240 per guest night | Transformative |

| Desert Naturalist | Ecology Doctorate | +40% | $150-220 per guest night | Educational |

| Culinary Anthropologist | Indigenous Cuisine + Fine Dining | +30% | $90-150 per guest night | Cultural Immersion |

| Adventure Choreographer | Expedition Leading + Luxury Service | +25% | $220-280 per guest night | Exhilarating |

| Wellness Alchemist | Traditional Healing + Modern Therapy | +35% | $180-260 per guest night | Restorative |

The Dark Sky Concierge experience was worth the entire cost of our stay. Using research-grade equipment and guided by someone who could explain complex astronomical concepts in accessible terms completely transformed our understanding of the night sky. The moment we viewed Saturn's rings through the telescope while sipping custom-crafted cocktails under a blanket of stars was simply magical. We've already booked our return stay during a different meteor shower.

— Tech Entrepreneur, Guest at Arizona Desert Resort

Technology integration requires exceptional thoughtfulness in environments where guests simultaneously expect seamless convenience and authentic disconnection. At a remarkable UAE property, I experienced their "invisible technology" philosophy where advanced systems anticipate needs without creating obtrusive digital touchpoints.

Revenue optimization in the desert luxury context follows counterintuitive patterns that defy conventional yield management wisdom. During operational reviews with several top-performing properties, I discovered their deliberate practice maintaining artificial capacity constraints even during peak demand periods.

-

Counterintuitive Revenue Strategy:

- Intentionally operating approximately 25% below actual capacity

- Preserving experience quality and exclusivity perception

- Enables continued rate growth and higher per-capita supplementary spending

- Supplementary spending often exceeding $500 daily per guest

- Strengthens long-term brand positioning that supports continued rate growth

We're selling serenity and space above all else. Compromising that for incremental revenue would undermine our fundamental value proposition. Our occupancy strategy prioritizes the guest experience over theoretical maximum revenue, which paradoxically results in higher total returns.

The desert's ancient landscapes might seem unlikely settings for hospitality innovation, yet they've emerged as laboratories for some of the industry's most revolutionary approaches. For investors willing to embrace specialized methodologies rather than applying conventional formulas, these sunbaked expanses offer not just distinctive experiences for guests but exceptional returns that continue outpacing traditional luxury categories.

Final Investment Perspective

The transformation of apparent contradiction - luxury amid austerity - into compelling investment proposition represents one of contemporary hospitality's most fascinating narratives, one that continues unfolding across deserts worldwide as pioneering operators convert sand into gold through visionary approaches and disciplined execution.